The financial planning world can sometimes feel overly complicated with technical terms, rules and regulations, and experts offering their help (for a fee of course!). Like most people, my very first account was a savings account at my local bank at the tender age of 14. I obtained a waiver from the school district to grant me working papers so I could work a job loading snack vending machines in the local community. Upon receiving my first paycheck I had no idea what to do with it! Do I save the money? Do I buy a new video game? Do I buy the latest pair of Air Jordans? In hindsight, I should have purchased the sneakers given the crazy prices vintage Jordans are getting! Luckily my parents influenced me to simply deposit the money into a bank to earn interest.

After college, I received my first “big” paycheck so I had many more options than simply a savings account. Aside from paying down my college loan debt (more on that in a separate blog), I knew I wanted to save for retirement and invest in the stock market. But new questions arose now that my financial life was more complicated…

What kind of account should be used first? Second?

Should all money simply be placed in a retirement account? Which one?

What are the advantages of a retirement account vs. an investment account?

When looking up options on various websites, it is easy to understand why this is so complicated. For retirement accounts, there is the 401k (solo and employer-sponsored), 403b for non-profits, 457 plans for state/local government employees, Thrift Savings Plans for federal employees, and several Individual Retirement Accounts (Roth, SEP, Traditional, SIMPLE), and pensions. And that’s just for retirement! Beyond that, there is the Health Savings Account (HSA), brokerage accounts, and Employee Stock Purchase Plans. Each account has its own unique qualities and advantages so selecting the order of investing can be important to earning the most money while minimizing tax implications.

Criteria for Determining Priority

- Free Money – This is self-explanatory! Free money is part of your compensation so this should be prioritized at the top of your list.

- Almost Free Money – While not as good as “free money”, several publicly traded companies give stock to their employees at a deep discount. While you still pay for the stock is often a significant percentage cheaper than the retail price.

- Tax-Advantaged – There are several layers of tax-advantaged accounts that include tax deferment, tax-free growth, and tax-free on withdrawal in retirement. All are important to consider when developing a strategy.

Now that we understand the general criteria I use for prioritizing investing, let’s dive into my “ideal order” of investing.

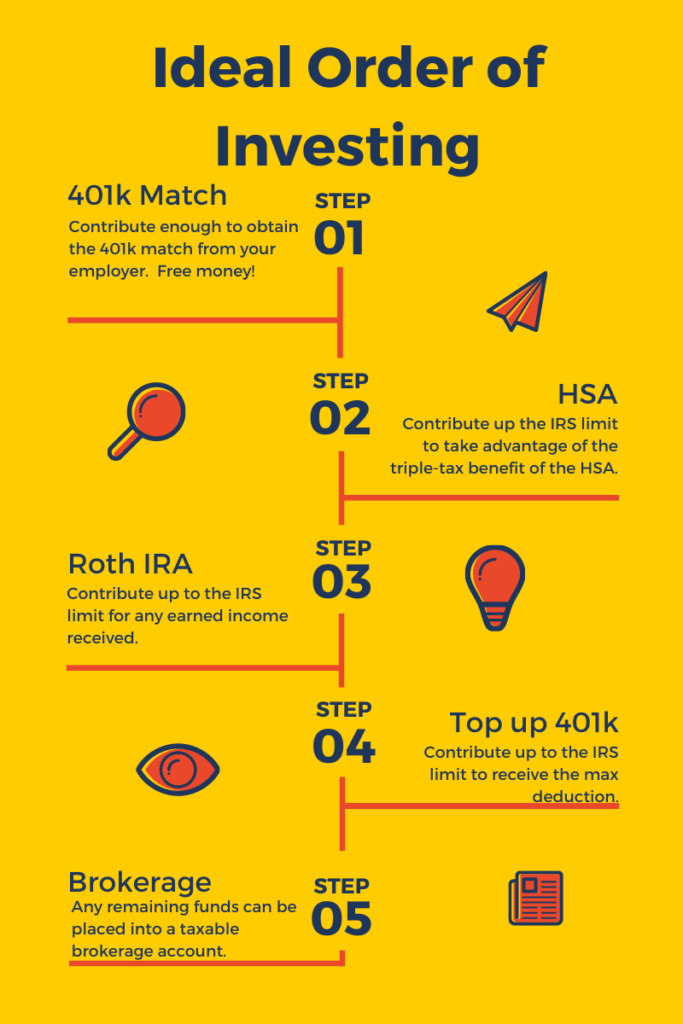

Ideal Order

0. Fund an emergency fund and pay off high-interest debt.

Ok…I know this is not a retirement or investment account but having an emergency fund is the first step. Financial experts suggest having at least 3-6 months of expenses set aside in a high-yield savings account that is easily accessible at a moment’s notice. Also, any high-interest credit card or personal loan debt should be tackled first before investing.

1. Contribute to your 401k up to the company match.

Free money! If your employer offers a company match up to a certain percentage then this should be at the top of your list. This is a GUARANTEED RETURN ON INVESTMENT so contributing up to the match is the best first step. Example: A company offers a 5% 401k match for an employee that makes $100,000 a year. If the employee contributes 5% of their income ($5,000) to the 401k then the company will give the employee another $5000 bringing the total to $10,000. Free money!

1a. Participate in the employee stock purchase program (ESPP).

2. Contribute the maximum to the Health Savings Account if you are eligible.

After contributing up to the 401k match and participating in the ESPP (if one is available), moving over to tax-advantaged accounts is the next step. The HSA is at the top of the list because it is the only triple tax-benefit account available. You will need to be enrolled in a High Deductible Health Plan to take advantage of the HSA. The trick to the HSAs…DO NOT USE IT FOR HEALTH CURRENT SPENDING! Invest the money in the stock market and let it compound until retirement. You can read more about the HSA HERE and HERE.

3. Contribute to the maximum to the Roth IRA or perform a Backdoor Roth Conversion.

The Roth IRA is the next best thing after the HSA. The Roth IRA gives you tax-free growth in the stock market and tax-free withdrawals in retirement. As with any IRA, you would need to have earned income and there are IRS restrictions as to who can contribute directly to a Roth IRA. To get around the IRS restriction, you could consider doing a Backdoor Roth Conversion.

4. Finish maxing out your 401k up to the IRS limit.

5. Invest in a taxable brokerage account.

Helpful Resources

How Do I Invest?

-

I contribute up the 401k match and immediate invest the contribution in an S&P 500 Index Fund. I personally invest in the Roth 401k and not the Traditional 401k because I want to build a tax free nest egg.

-

After the match, I make sure to maximize my family contribution to the HSA and invest it. I don’t use my HSA for health expenses since I pay out of pocket.

-

For years that I make above the IRS limit, I perform a Backdoor Roth conversion for the maximum contribution limit on January 1st. For years that I make under the limit, I contribute the maximum amount directly to the Roth IRA.

-

After the match, HSA, and Roth investments I circle back to the 401k and top up the account to the IRS limit.

-

Finally, if I have a surplus of cash then I invest into my taxable brokerage account.