No… I didn’t inherit a vacation home from a rich uncle and this is not some scammy infomercial or YouTube advertisement. I really did purchase a vacation home (actually two) for my family to enjoy and it cost me zero dollars. I know, it sounds too good to be true. It took me a long time to figure out a real estate investment strategy that not only benefits me financially but more importantly provides a lifestyle for my family to enjoy a vacation in a desirable area of the United States whenever we want to go.

But it wasn’t always that easy…

My first try at real estate investing ended miserably. I was influenced to jump into the real estate business by the many home improvement and home flipping shows on television over the past 20 years. The television shows give a false sense of simplicity and a get rich quick aura. I purchased a small one bedroom condo in a major city that was located near large hospitals and world renowned universities…how could I lose? I learned really quick that being a landlord is not fun and the location of the property is critical. Frozen pipes, broken plumbing, nonpaying tenants, threats from tenant’s parents (yup…that happened), an annoying HOA, threat of lawsuits, and tenants violating the no pet policy are just a sample of the issues I encountered. Oh, did I mention that I bought property in 2007 and it lost 25% of its value during the Great Recession? Fun times. I ended up selling the property for $15,000 less than I purchased it for and walked away. Any normal person would never attempt that again.

While I learned very good life lessons with my first attempt with real estate investing, it didn’t really click until I found an investing strategy that matched my real estate investing goals.

Real Estate Investing Goals

As with everything in life, having clear, realistic goals for what we wish to accomplish is needed before acquiring a property. The primary failure in my first attempt was most likely a result of not having goals and being completely naive to the process. In my second attempt at real restate investing I decided to create clear and concise goals before setting out on another real estate investing journey.

My Real Estate Investment Goals (2nd attempt):

- Purchase homes in vacation areas that my family and friends can use. Example locations: Cape Cod, Jackson Hole, Gatlinburg, etc

- Open up my homes to short-term rental guests when they are not being used by my family and friends.

- Have ZERO dollars of my own money invested in the properties.

- Generate enough cash flow to cover all expenses.

- Pass down the properties to my children to manage and use for their families.

Of the goals on the list, I decided that Goal #3 (Have zero dollars of my own money invested in the properties) would be the hardest to achieve. Using outside investors was not really possible given my past failure in real estate investing and it makes it harder to pass down the property to heirs. Luckily, I stumbled upon a real estate investing strategy that has been used countless times.

The traditional method of real estate investing is buying a property with money financed by bank. Typically, the bank will ask for 20-25% down payment on a second home or investment property. The investor can then rent out the property and use the cash flow to pay down the bank note over 15-30 years. The problem with this approach is the money that was used for the down payment is now locked away in the property so the investor will need to save addition cash to cover the down payment if they wish to purchase another property. Enter the BRRRR Method.

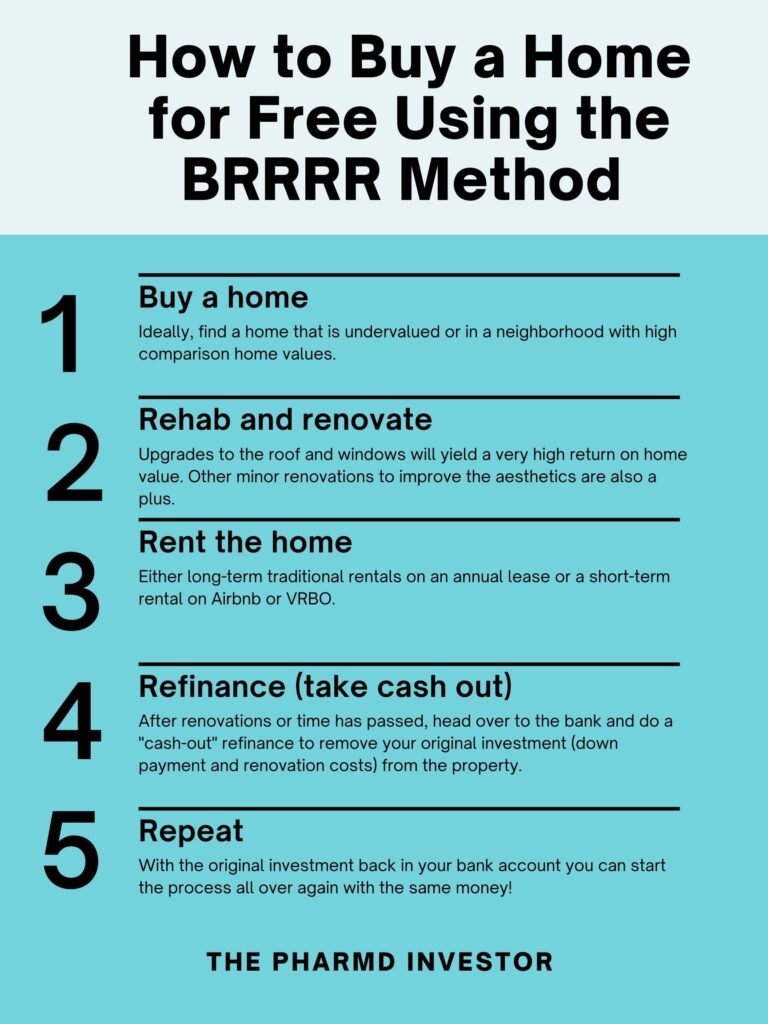

The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment strategy for “buy and hold” investors to purchase properties with the intent of “cash out” refinancing to use the same money to purchase additional properties.

**Note: There are many different types of real estate investment strategies such as REITs, House Flipping, Syndication, etc that I won’t cover here. I am simply sharing a method that has worked for me**

The Process:

- BUY – As with the traditional method, most banks will require a 20-25% down payment to purchase property. For example, a $300,000 home will require $60k-$75k of cash on-hand just to purchase the home. That’s a lot of money to save only to give it to a bank to hold as long as you own the home! (You could open a HELOC to access the money but I’ll cover that in a different blog post)

- REHAB – The primary goal of the rehab is the make the home livable and command a rent that is needed to cover the monthly mortgage payment and produce cash flow. Simple upgrades such as painting the kitchen cabinets, replacing bathroom fixtures, paint, and cleaning up landscaping can go a long way. Of note, a roof and window replacement will dramatically improve the value of a home.

- RENT – After all renovations are complete, it’s time to make some money! It’s important that the rent covers all expenses and produces a cash flow.

- REFINANCE – After a tenant is in the property paying rent and time has passed from the original mortgage, you can approach the bank again to initiate a refinance. The bank will order an appraisal of the property. In the example above, the goal would be to have the property appraise $60-$75k higher than the original purchase price so the money can be “cashed out.”

- REPEAT – After the refinance, you should have the original $60k-$75k back in your bank account and you still own the property! The money can be used to purchased another investment and starting the entire process over again.

If done correctly, you can literally use the same down payment money over and over again to build a real estate portfolio. However, the method has been proven with traditional rentals (the annual lease kind) and not with short-term rentals (the Airbnb kind). Given that my real estate investing goal is to own homes in vacation areas and rent them on Airbnb when I am not using them…could the BRRRR method work?

How I Purchased a Vacation Home for Free

In 2017, my wife and I set out to buy a cottage on Cape Cod. We have been vacationing there every year for the past 40 years so the Cape was a natural location to purchase a home. We decided to purchase a small two bedroom cottage (See our cottages HERE) in the historic seaside town of Wellfleet, Massachusetts. We emptied our savings account for the $50,000 down payment required by the bank. After purchasing the cottage, we immediately renovated the property with new furnishings, new windows, a new AC system, and convinced the HOA to replace our roof. We listed the property on Airbnb and filled up the summer calendar with enough guests to cover all of our fixed annual expenses plus the renovation costs. After two years, we refinanced the property and pulled the original $50,000 (plus a little extra) out of the property and moved the money back into our bank account to purchase another property….which we did.

Not only are all expenses covered by the Airbnb guests but we have two permanent vacation homes in a desirable area. We head to Cape Cod every month for short weekend trips and longer stays with our extended family. This was very convenient during the early days of the pandemic! We basically moved to Cape Cod and worked from our vacation homes while our kids attended school online.

What is my approach to real estate investing?

-

I use a modified BRRRR method as my real estate investment strategy.

-

My goal is to have vacation homes in the mountains, at the beach, on a lake, in a major city, and any other fun place to visit.

-

I rent my properties on Airbnb for part of the year and use the properties for my enjoyment.

-

I do a cash out refinance a few years after the original purchase when the value of the property has increased.

-

I use the cash to purchase new properties or pay down personal debt.