What is an HSA?

Congratulations if your employer offers an HSA option as part of your health benefit package! But what exactly is a Health Savings Account (HSA)? To most people this account is used (incorrectly) as a tax free savings account to pay for Physician office visits and co-pays throughout the year. If you are doing this then you are missing out on THE BEST retirement savings account available to Americans. I’ll share the secret to this account in a bit.

HSAs were established as part of the Medicare Modernization Act (MMA) signed into law in 2003. The MMA created the Health Savings Account statute to make available a tax advantaged (i.e., you don’t pay taxes on this money) account for Americans enrolled in a high-deductible health plan (HDHP).

Fast forward 17 years…Many people confuse a Health SAVINGS Account (HSA) with a Flexible SPENDING Account (FSA). I certainly made this mistake for years. In an FSA, you have the option to tuck away tax free money and use the account for healthcare spending during the calendar year for your health needs. I always ended up with a balance at the end of the year which necessitated a frantic trip to CVS to buy up a 10 year stockpile of vitamins. Nowadays Amazon and Walmart pings us with friendly reminders to simply click buttons to liquidate the FSA account. But an HSA is very, very different and should NOT be used like an FSA. HSA is a SAVINGS account that may (and should) be used for future health expenses and not for spending now. HSA funds are not lost at year end and are “rolled over” to the next year. Let’s see how this all works.

How Does it Work?

During the open enrollment period, you typically select a healthcare plan offered by your employer. Some employers offer a high-deductible health plan that offers lower premiums (i.e., less money deducted from your paycheck each period) with higher deductibles. These high deductible health plans are great for young and/or healthy individuals who consume fewer health resources during the year.

**A side note…you should have an emergency fund in place if you have an HDHP to cover the high deductible requirements.**

Qualifications to Open an HSA:

- You are covered under a high deductible health plan (HDHP) on the first day of the month.

- You have no other health coverage

- You aren’t enrolled in Medicare

- You can’t be claimed as a dependent on someone else’s tax return

If you qualify, you can sign up for an HSA HERE.

After you open an HSA, you can contribute tax free money via payroll deduction into the account and use the funds for qualified medical expenses. But I have a better idea! Don’t use the HSA for qualified medical expenses in your relative healthy years unless you absolutely have no other savings or FSA. Let’s talk about the secret that your financial advisor, friends, and benefits office is not telling you.

The Secret

The best kept secret is the HSA is basically an Individual Retirement Account (IRA) if you treat it like one. Even better, an HSA is funded tax free, grows in the stock market tax free, and can be distributed tax free for qualified medical expenses that you will absolutely have as your age advances. I will say that again if you missed it…The HSA is a triple tax free investment vehicle available to you. You can create a massive investment account over your career and reap the benefits of tax free distribution after decades of growth in the stock market. There is no other investment account like this!

Example

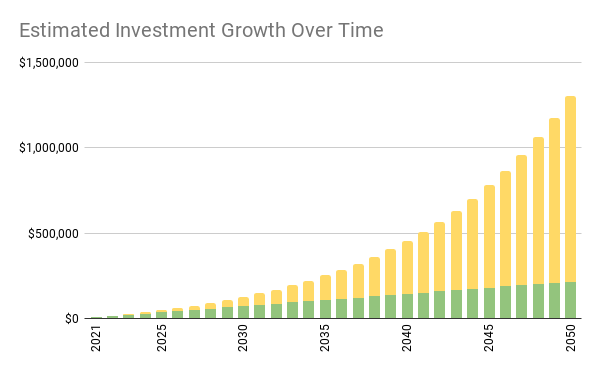

Let’s assume the current IRS annual family contribution limit of $7200 stays the same over the life of a 25 year old young professional. I know, I know…it will definitely increase every few years but I want to keep this example simple. Let’s also use the historic annual stock market gains of 10%.

At 55, our young(ish) professional would now have an HSA worth $1.3 Million Dollars! You can double check my math HERE.

How Do I Personally Use an HSA?

-

I maximize the IRS contribution limits on an annual basis (contact your HR Benefits office to set this up during open enrollment). In 2021 this is $3,600 for an individual and $7,200 for a family. Older than 55 gets an additional catch-up contribution of $1000.

-

I immediately invest the payroll deduction every two weeks in an S&P 500 index fund.

-

I pay for my current medical expenses out of pocket or dip into my emergency fund if I truly need a large sum.

-

I document all of my medical expenses in Evernote and on a Google Spreadsheet (there is a super secret trick that I’ll explain in a future blog post that permits you to take out the money well before retirement).

-

I plan to let the investment grow and NEVER sell. And I mean never. I’ll just let that thing ride the rollercoaster up and down until I retire. I may use it to fund an early retirement bridge to Medicare.

-

At 65, the HSA basically becomes a traditional IRA and can be used for non-qualified expenses (boat, trips to Milan, space tourism on Blue Origin, etc). However, it will be taxed as such.