I remember the first time I learned about the Roth IRA. I was looking for ways to increase my retirement savings beyond my employer pension (I am that old) and the 403b/401k plan. I asked my financial advisor if the Roth IRA was a good option for me to save for retirement and have tax-free money down the road. He gleefully informed me that my household income exceeded the IRS qualification limits so the Roth IRA was not available to me. He proceeded to try to sell me useless whole life insurance and annuities….but I didn’t take the bait. Luckily, I spent my personal time listening to financial podcasts and reading blogs (I know…boring) so I stumbled on a trick that some high earners were doing to skirt the IRS rules at the time and gain access to the Roth IRA.

Backdoor Roth conversion explained

The “Backdoor Roth IRA” is a method for high-income earners to sneak money into a Roth IRA regardless of the IRS contribution limits. It’s not as nefarious as it sounds! The Roth IRA is a special kind of retirement account where invested funds can grow tax-free and are not subject to income tax when withdrawn in retirement (read more about the benefits of the Roth IRA…HERE). Sounds amazing right? If you are nearing retirement then you know that tax planning is a critical step if you have most of your money locked into a 401k or Traditional IRA. If you are at the beginning of your career or in the prime of your career then tax planning hasn’t hit your radar yet. It will.

There is a catch! The Roth IRA is NOT available to individuals with high paying jobs. Once the individual or household exceeds the IRS limit ($140k for individual and $208k for married), the Roth IRA is no longer available.

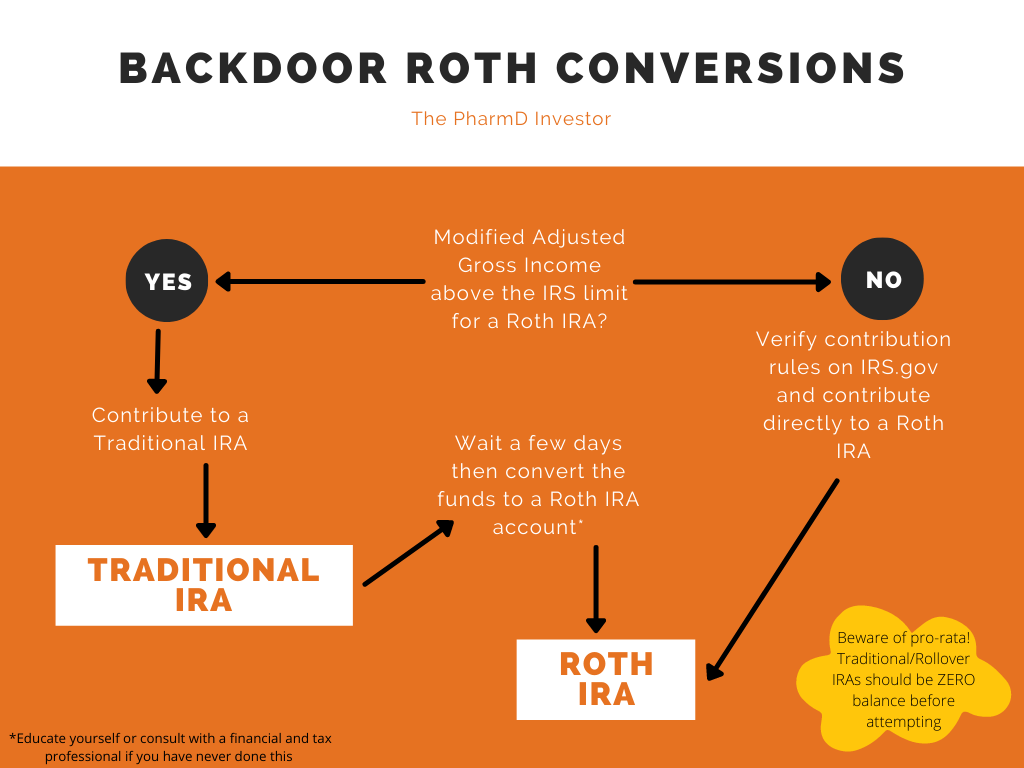

This brings us to the Backdoor. The Traditional IRA does NOT have the same income limits that the Roth IRA has so anyone with earned income can contribute to a Traditional IRA. The IRS also permits funds that are within a Traditional IRA to be converted to a Roth IRA if taxes are paid on the converted funds. Some very creative high earning investors realized this loophole in the tax code! The Backdoor method permits high earners who are prevented from contributing to the Roth IRA directly to still contribute to the Traditional IRA and immediately convert the contribution to a Roth IRA. Bingo! The Roth IRA is available to everyone.

Most Common Types of Roth IRA Conversions:

- Classic Backdoor Roth – contribute to Traditional IRA then convert to Roth IRA within days of the contribution.

- Pre-Retirement Conversions – convert existing funds within a Traditional IRA to a Roth IRA. This is typically done while in lower tax brackets in your pre-retirement years. (I will cover this in a future blog post)

- Mega-Backdoor Roth – individual makes after-tax contributions to a 401k then converts to a Roth IRA. The Mega Backdoor is not available to everyone and is dependent on the employer’s 401k plan documents. (I will cover this is a future blog post as well)

How to set up a Backdoor Roth?

Beware of tax landmines!

The Backdoor Roth conversion is littered with tax landmines. First, any money converted from a tax-deferred account (401k, Traditional IRA, etc) to a Roth IRA is subject to taxes. The conversion is viewed as a distribution by the IRS so the funds will be taxed on your tax return. Second (and most importantly), existing money in ANY Rollover IRA or Traditional IRA is subject to the pro-rata rule. The rule is applied by the IRS to tax a proportion of the conversion as a component of ALL of existing funds in any IRA. Put simply, the pro-rata rule means that the IRS treats all existing IRAs as one communal account so the amount of your Roth conversion that is taxable is prorated over your total IRA balance. If you don’t have any Traditional or Rollover IRAs then this won’t be an issue. If you have an existing Traditional or Rollover IRA then it can create a significant tax situation.

Important considerations

- Money that is converted from a Traditional IRA to a Roth IRA is considered a conversion and NOT a contribution. These funds must remain within a Roth IRA for at least 5 years before they can be withdrawn.

- Doing conversions with existing money in a Rollover or Traditional IRA can create significant tax situations. This typically happens if you left an employer and rolled the 401k funds into a Rollover IRA. Similarly, this can happen if you contributed to a Traditional IRA directly over the years and let it grow within the Traditional IRA. Moving all existing money within a Rollover/Traditional back into an employer-sponsored plan (401k) is one way to avoid the pro-rata rule tax implications.

- Start the year with a ZERO balance in your Traditional/Rollover IRA before attempting the Backdoor Roth conversion to minimize tax landmines.

Is this legal?

Yes! There was a period of time when the Backdoor Roth IRA was considered a potentially “dangerous” loophole in the tax code. Many accountants and financial advisors recommended against the Backdoor Roth. This all changed in 2017 when the Tax Cuts and Jobs Acts acknowledged the existence of the Backdoor Roth and was further validated in 2018 when the IRS notified the public of its legality (if done properly!).

Example

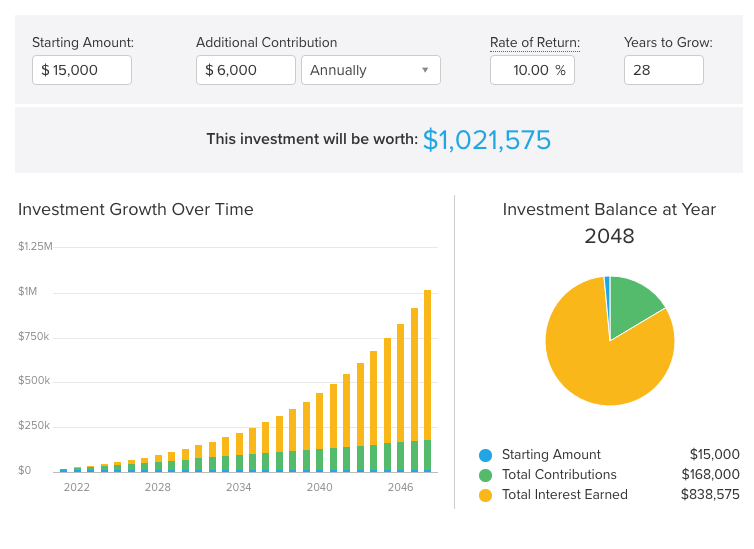

A 32 year old professional with $15k in a Roth IRA recently got married and now finds that she no longer qualifies for Roth IRA contributions because the combined income with her spouse exceeds the IRS limit. She decides to continue fundings her Roth IRA using the Backdoor method. She deposits $6000 into a newly opened Traditional IRA and invests the money in a broad market index fund. After a few days,she logs into her investment bank’s website and converts $6056 (growth plus original contribution) to her existing Roth IRA. This money can now grow tax free and can be withdrawn in retirement tax free! If she does this annually until the age of 60, she could have over $1 million in tax free money! (Using 10% annual growth rate)

Helpful Resources

What is my approach?

-

On January 1st of each year I contribute the maximum allowable amount to my Traditional IRA.

-

I invest the contribution in a money market fund within the Traditional IRA.

-

On or around January 3rd, I log into my Fidelity account and convert the Traditional IRA contribution to my Roth IRA.

-

After the money market fund is transferred into the IRA I make new selections within the Roth IRA according to my financial plan.

-

On annual basis, I inform the IRS that I have completed a Backdoor Roth and I pay taxes on the converted $$. I use TurboTax so they make it super easy to inform the IRS.

-

I let the Roth IRA grow and keep doing the Backdoor Roth conversions annually until my income drops below the IRS limits.