My initial introduction to retirement planning was at the age of 23 when I started my first job as a Pharmacist in Boston, MA. I remember receiving a paper memo (yeah I’m that old) in my mailbox asking me to make my 401k elections. I made random selections based on the coolness of the investment fund name and moved on. After several years and several prescriptions later, I stumbled upon a completely different retirement account that I was not taking advantage of….the Individual Retirement Account (IRA).

What is an Individual Retirement Account?

An IRA is an investment account that individuals can use to tuck away money for retirement. The money can be invested in the stock market and grows tax-free until the funds are withdrawn in retirement. The contribution into the IRA may yield a deduction on tax returns but this depends on income levels and ability to contribute to other qualified retirement plans. For most employed professionals (Pharmacists, Physicians, etc), the contribution is not deductible on taxes but this does not prohibit the ability to contribute to an IRA. See 2021 IRA Deduction Limits HERE.

The 3 Major Types of IRAs:

- Traditional IRA – Contributions are made with after tax money (i.e., money that you already paid payroll tax on) but may be deducted on your tax return depending on income level. Earnings grow tax-deferred until you withdraw the funds in retirement. The tax on the distribution in retirement is typically lower than the tax you’d pay in the prime of your career.

- Roth IRA – Contributions to this account are made with money you’ve already paid taxes on, the money grows tax-free, and the money is distributed tax-free in retirement. There are specific restrictions on this kind of IRA that prevents high-wage earners from contributing directly to the IRA. (High earners can use the Backdoor Roth conversion method to get around this restriction).

- Rollover IRA – This is similar to a traditional account however, the funds in this account have “rolled over” (transferred) from an employer-sponsored plan, such as a 401(k) or 403(b), into the IRA.

Roth IRA

The Roth IRA , initially called the “IRA Plus”, was an idea proposed by Senator Bob Packwood of Oregon and Senator William Roth of Delaware. It was established in the Taxpayer Relief Act of 1997 and provided the ability for Americans to make non-deductible contributions to a special IRA that could be used tax-free in retirement.

Advantages include:

- Tax-free retirement income

- Easy early access to money

- Not subject to RMDs (required minimum distributions)

- Passes on to heirs tax-free

- Available to any American with earned income

Disadvantages include:

- Taxes are paid upfront

- No tax deductions for contributions

- High earners can not contribute directly

- Individuals must setup the account on their own and not with an employer

What makes a ROTH so special?

The money within a Roth IRA grows tax free and can be distributed tax free! All interest, dividends, and capital gains are left in the account to compound over time without fear of the IRS taxing it in retirement. Even more, direct contributions to a Roth IRA can be removed at any time without penalty should you need the money before retirement age of 59.5 years. After the age of 59.5, contributions, conversions, and the earning can be withdrawn tax free. The account must be open for at least 5 years to take a qualified distribution. In addition, there are exceptions that permit the early withdrawal of the earnings before the age of 59.5. These include purchase of a first home (up to $10,000), for medical expenses greater than 7.5% of adjusted gross income, and to help pay for college expenses.

Qualifications to contribute to a ROTH IRA:

- You must have “Earned income” in the given tax year to contribute. This means you actually earned money from a job, side hustle, or small business. Earned income includes wages, tips, etc.

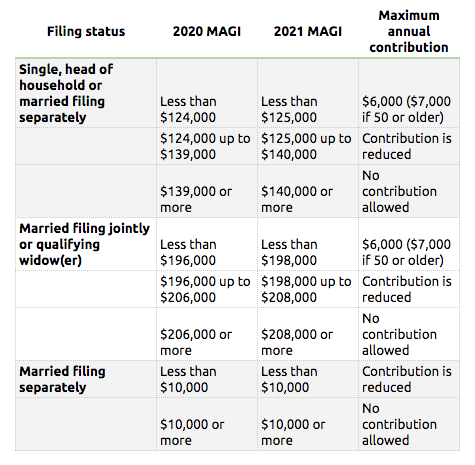

- The are Income limits to contribute directly to a Roth IRA:

Example

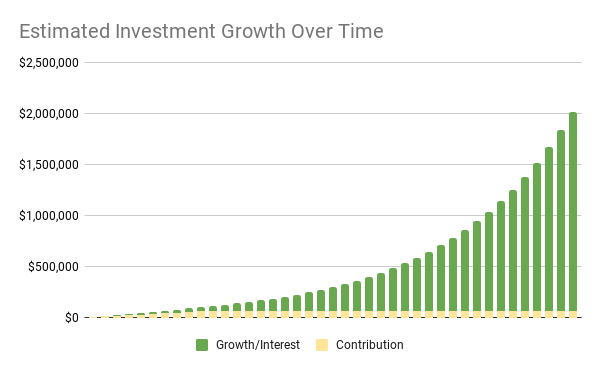

Let’s assume that a financially literate professional decided (and was eligible) to fund the maximum contribution of $6000 to their IRA between the ages of 27 to 37 years. At the age of 37 the professional decides to stop contributing to the account so only 10 years, or $60,000, of contributions are left in the Roth to grow in the stock market. Let’s also use the historic annual stock market gains of 10%.

At retirement age of 67, the Roth IRA that has not received a contribution in over 30 years could be worth $2 Million! And the best part…this is all tax free money!

**There is a nasty rumor that individuals with an employer sponsored retirement plan (i.e 401k, TSP, etc) are not eligible to contribute to an IRA. This is false! You most likely will not be able to deduct the contribution on tax returns but you can contribute to an IRA…if you have earned income.**

Getting Started with a Roth IRA?

- I recommend using your existing investment bank such as Fidelity, Vanguard, etc. This keeps everything in one location and simplifies your finances.

- Learn! There is an abundance of information online. Below is a list of my favorite places to learn about the Roth IRA.

Podcasts:

Your Money, Your Wealth (iTunes, Google Play, YouTube)

Stacking Benjamins (iTunes, Google Play)

How Do I Personally Use a Roth IRA?

-

I contribute the maximum IRS limit on an annual basis. In 2021 this is $6000. Older than 55 gets an additional catch-up contribution of $1000.

-

During years that I make less than the Roth IRA income limit, I make a direct contribution on Jan 1st.

-

During years that I make more than the Roth IRA income limit, I make a direct contribution to a Traditional IRA and perform a “Backdoor Roth Conversion” a few days later. This is a loophole in the tax law that permits individuals to contribute to a Traditional and move it over to a Roth. Read more about the Backdoor Roth conversion HERE.

-

I immediately invest the contribution or converted funds in an S&P 500 Index fund.

-

I plan to make the Roth IRA a major component of my retirement portfolio. In fact, I plan to convert most (all?) of my 401k to a Roth IRA when my tax bracket is lower.

-

In time, the Roth IRA will also serve as my emergency fund since contributions can be removed penalty free. This is dependent on the “5 Year Rule” which I will cover in a future blog post.